SOLUTIONS AND DISCUSSIONS:

[See Accounting for Sanitary Landfills: Illustrative Problem]

http://theaudituniverse.blogspot.com/2016/05/accounting-for-sanitary-landfill.html

[See Accounting for Sanitary Landfills: Illustrative Problem]

http://theaudituniverse.blogspot.com/2016/05/accounting-for-sanitary-landfill.html

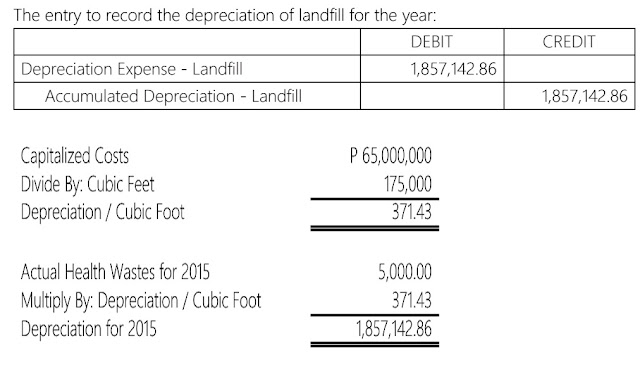

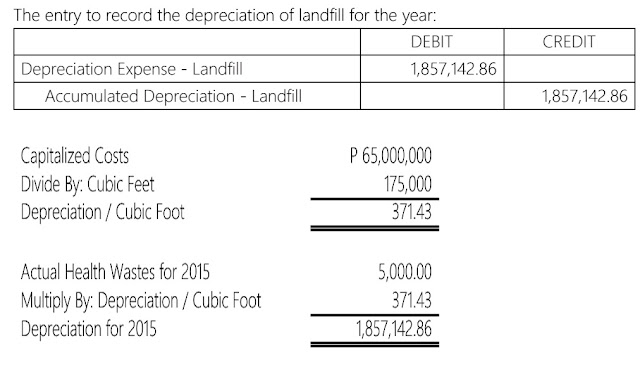

Generally, land has an unlimited useful life and therefore is not depreciated. In some cases, the land itself may have a limited useful life (in case of QUARRIES AND LANDFILLS), in which case it is depreciated in a manner that reflects the benefits to be derived from it. [International Accounting Standards 16, paragraphs 58-59]

If the cost of land includes the costs of site dismantlement, removal and restoration, that portion of the land asset is depreciated over the period of benefits obtained by incurring those costs. [International Accounting Standards 16, paragraph 59]

Thus, using these provisions from IAS 16, the following entries shall be provided by the RICH KIDS HOSPITAL for the year 2016: